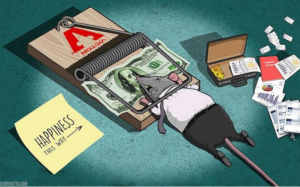

Get this, starting on January 1, 2024, our nasty Senators and Congressmen have now activated a LAW that considers all businesses with less than $5 million in revenue and 20 employees or less to be FIRST considered as financial criminals.

The law now mandates reporting of the BENEFICIAL OWNERS of ALL companies and businesses operating in the USA FINANCIAL CRIMES ENFORCEMENT NETWORK (FInCEN) or face fines and JAIL!

AS SMALL BUSINESS YOU ARE ALL SUSPECTED CRIMINALS1

Financial Crimes Enforcement Network (FinCEN) issued a final rule implementing the bipartisan Corporate Transparency Act’s (CTA) beneficial ownership information (BOI) reporting provisions. The rule will enhance the ability of FinCEN and other agencies to protect U.S. national security and the U.S. financial system from illicit use and provide essential information to national security, intelligence, and law enforcement agencies; state, local, and Tribal officials; and financial institutions to help prevent drug traffickers, fraudsters, corrupt actors such as oligarchs, and proliferators from laundering or hiding money and other assets in the United States.

Illicit actors frequently use corporate structures such as shell and front companies to obfuscate their identities and launder their ill-gotten gains through the United States. Not only do such acts undermine U.S. national security, they also threaten U.S. economic prosperity: shell and front companies can shield beneficial owners’ identities and allow criminals to illegally access and transact in the U.S. economy, while disadvantaging small U.S. businesses who are playing by the rules. This rule will strengthen the integrity of the U.S. financial system by making it harder for illicit actors to use shell companies to launder their money or hide assets.

Recent geopolitical events have reinforced the point that abuse of corporate entities, including shell or front companies, by illicit actors and corrupt officials presents a direct threat to the U.S. national security and the U.S. and international financial systems. For example, Russia’s illegal invasion of Ukraine in February 2022 further underscored that Russian elites, state-owned enterprises, and organized crime, as well as Russian government proxies have attempted to use U.S. and non-U.S. shell companies to evade sanctions imposed on Russia. This rule will enhance U.S national security by making it more difficult for criminals to exploit opaque legal structures to launder money, traffic humans and drugs, and commit serious tax fraud and other crimes that harm the American taxpayer.

At the same time, the rule aims to minimize burdens on small businesses and other reporting companies. Millions of businesses are formed in the United States each year. These businesses play an essential and important economic role. In particular, small businesses are a backbone of the U.S. economy, accounting for a large share of U.S. economic activity and driving U.S. innovation and competitiveness. U.S. small businesses also generate millions of jobs, and in 2021, created jobs at the highest rate on record. It is anticipated that it will cost reporting companies with simple management and ownership structures—which FinCEN expects to be the majority of reporting companies—approximately $85 apiece to prepare and submit an initial BOI report. In comparison, the state formation fee for creating a limited liability company (LLC) can cost between $40 and $500, depending on the state.

Beyond the direct benefits to law enforcement and other authorized users, the collection of BOI will help to shed light on criminals who evade taxes, hide their illicit wealth, and defraud employees and customers and hurt honest U.S. businesses through their misuse of shell companies.

The rule describes who must file a BOI report, what information must be reported, and when a report is due. Specifically, the rule requires reporting companies to file reports with FinCEN that identify two categories of individuals: (1) the beneficial owners of the entity; and (2) the company applicants of the entity.

The final rule reflects FinCEN’s careful consideration of detailed public comments received in response to its December 8, 2021 Notice of Proposed Rulemaking on the same topic, and extensive interagency consultations. FinCEN received comments from a broad array of individuals and organizations, including Members of Congress, government officials, groups representing small business interests, corporate transparency advocacy groups, the financial industry and trade associations representing its members, law enforcement representatives, and other interested groups and individuals.

Balancing both benefits and burden, the following are the key elements of the BOI reporting rule:

Reporting Companies

- The rule identifies two types of reporting companies: domestic and foreign. A domestic reporting company is a corporation, limited liability company (LLC), or any entity created by the filing of a document with a secretary of state or any similar office under the law of a state or Indian tribe. A foreign reporting company is a corporation, LLC, or other entity formed under the law of a foreign country that is registered to do business in any state or tribal jurisdiction by the filing of a document with a secretary of state or any similar office. Under the rule, and in keeping with the CTA, twenty-three types of entities are exempt from the definition of “reporting company.”

- FinCEN expects that these definitions mean that reporting companies will include (subject to the applicability of specific exemptions) limited liability partnerships, limited liability limited partnerships, business trusts, and most limited partnerships, in addition to corporations and LLCs, because such entities are generally created by a filing with a secretary of state or similar office.

- Other types of legal entities, including certain trusts, are excluded from the definitions to the extent that they are not created by the filing of a document with a secretary of state or similar office. FinCEN recognizes that in many states the creation of most trusts typically does not involve the filing of such a formation document.

Beneficial Owners

- Under the rule, a beneficial owner includes any individual who, directly or indirectly, either (1) exercises substantial control over a reporting company, or (2) owns or controls at least 25 percent of the ownership interests of a reporting company. The rule defines the terms “substantial control” and “ownership interest.” In keeping with the CTA, the rule exempts five types of individuals from the definition of “beneficial owner.”

- In defining the contours of who has substantial control, the rule sets forth a range of activities that could constitute substantial control of a reporting company. This list captures anyone who is able to make important decisions on behalf of the entity. FinCEN’s approach is designed to close loopholes that allow corporate structuring that obscures owners or decision-makers. This is crucial to unmasking anonymous shell companies.

- The rule provides standards and mechanisms for determining whether an individual owns or controls 25 percent of the ownership interests of a reporting company. Among other things, these standards and mechanisms address how a reporting company should handle a situation in which ownership interests are held in trust.

- These definitions have been drafted to account for the various ownership or control structures reporting companies may adopt. However, for reporting companies that have simple organizational structures it should be a straightforward process to identify and report their beneficial owners. FinCEN expects the majority of reporting companies will have simple ownership structures.

Company Applicants

- The rule defines a company applicant to be only two persons:

- the individual who directly files the document that creates the entity, or in the case of a foreign reporting company, the document that first registers the entity to do business in the United States.

- the individual who is primarily responsible for directing or controlling the filing of the relevant document by another.

- The rule, however, does not require reporting companies existing or registered at the time of the effective date of the rule to identify and report on their company applicants. In addition, reporting companies formed or registered after the effective date of the rule also do not need to update company applicant information.

Beneficial Ownership Information Reports

- When filing BOI reports with FinCEN, the rule requires a reporting company to identify itself and report four pieces of information about each of its beneficial owners: name, birthdate, address, and a unique identifying number and issuing jurisdiction from an acceptable identification document (and the image of such document). Additionally, the rule requires that reporting companies created after January 1, 2024, provide the four pieces of information and document image for company applicants.

- If an individual provides their four pieces of information to FinCEN directly, the individual may obtain a “FinCEN identifier,” which can then be provided to FinCEN on a BOI report in lieu of the required information about the individual.

Timing

- The effective date for the rule is January 1, 2024.

- Reporting companies created or registered before January 1, 2024 will have one year (until January 1, 2025) to file their initial reports, while reporting companies created or registered after January 1, 2024, will have 30 days after receiving notice of their creation or registration to file their initial reports.

- Reporting companies have 30 days to report changes to the information in their previously filed reports and must correct inaccurate information in previously filed reports within 30 days of when the reporting company becomes aware or has reason to know of the inaccuracy of information in earlier reports.

Next Steps

- The BOI reporting rule is one of three rulemakings planned to implement the CTA. FinCEN will engage in additional rulemakings to (1) establish rules for who may access BOI, for what purposes, and what safeguards will be required to ensure that the information is secured and protected; and (2) revise FinCEN’s customer due diligence rule following the promulgation of the BOI reporting final rule.

- In addition, FinCEN continues to develop the infrastructure to administer these requirements in accordance with the strict security and confidentiality requirements of the CTA, including the information technology system that will be used to store beneficial ownership information: the Beneficial Ownership Secure System (BOSS).

- Consistent with its obligations under the Paperwork Reduction Act, FinCEN will publish in the Federal Register for public comment the reporting forms that persons will use to comply with their obligations under the BOI reporting rule. FinCEN will publish these forms well in advance of the effective date of the BOI reporting rule.

- FinCEN will develop compliance and guidance documents to assist reporting companies in complying with this rule. Some of these materials will be aimed directly at, and made available to, reporting companies themselves. FinCEN will issue a Small Entity Compliance Guide, pursuant to section 212 of the Small Business Regulatory Enforcement Fairness Act of 1996, in order to inform small entities about their responsibilities under the rule. Other materials will be aimed at a wide range of stakeholders that are likely to receive questions about the rule, such as secretaries of state and similar offices. FinCEN also intends to conduct extensive outreach to all stakeholders, including industry associations as well as secretaries of state and similar offices to ensure the effective implementation of the rule.

.

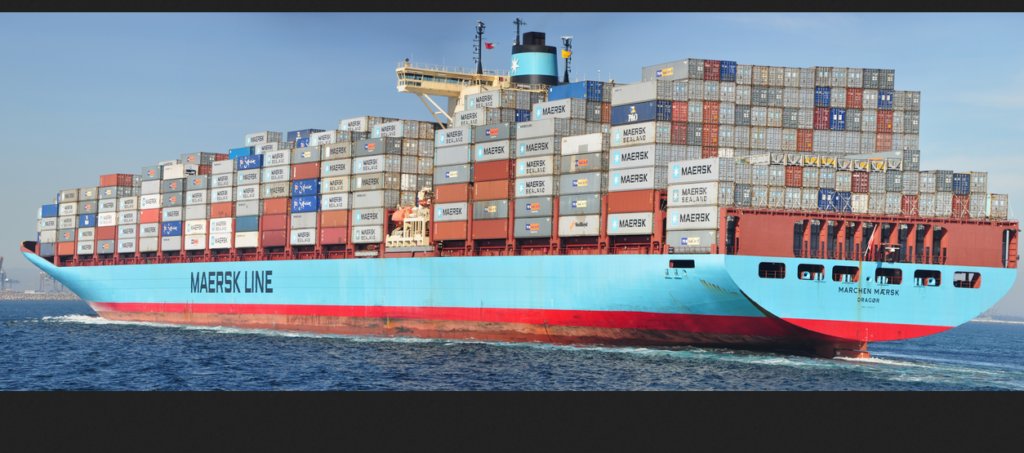

The steel frame of the Francis Scott Key Bridge sits on top of a container ship after the bridge collapsed, Baltimore, Md., on March 26, 2024. (Jim Watson/AFP via Getty Images)

The steel frame of the Francis Scott Key Bridge sits on top of a container ship after the bridge collapsed, Baltimore, Md., on March 26, 2024. (Jim Watson/AFP via Getty Images)